MassMutual Foundation #FutureSmart

Last week, I had the pleasure of attending a MassMutual Foundation #FutureSmart launch event at the Mildred Avenue Middle School in Mattapan, MA

Last week, I had the pleasure of attending a MassMutual Foundation #FutureSmart launch event at the Mildred Avenue Middle School in Mattapan, MA

As a father of two, I wish that my children had been taught about personal finances, money and planning for their futures in school. Outside of the stale stock market games that we’ve all played, I don’t think they were taught a single thing about money and how to deal with it.

MassMutual Foundation is committed to making sure the next generation is not only informed, but educated on all aspects of finance.

The foundation donated $20 million in an effort to bring the FutureSmart educational program to 2 million students by 2020.

Before this event, I took part in two #FutureSmart Twitter Chats. These are put on to spark conversation about financial education.

They are a great way to hear from a variety of parents, educators and financial experts on what is going on across the country when it comes to students learning about managing their finances.

So that you can get a feel for what is discussed here are a few of my Tweets:

A1 - My kids didn't learn at that age in school, but we tried to get them thinking about finances with their allowances. #FutureSmart https://t.co/4DpP23IXrd

— C.C. Chapman (@cc_chapman) September 28, 2016

A4 - If you give an allowance they need to earn it, not just expect it. #FutureSmart https://t.co/Cm0TTP1OZa

— C.C. Chapman (@cc_chapman) September 22, 2016

First one with a paycheck was bagging groceries at Purity Supermarkets. #FutureSmart https://t.co/VOXRIF4XOf

— C.C. Chapman (@cc_chapman) September 21, 2016

A3 - Only buy what you have the money for. Save for things you want. Work more if you need more money. #FutureSmart https://t.co/1JrorjB4HC

— C.C. Chapman (@cc_chapman) September 22, 2016

The chat showed me that a lot of parents are interested in how to try to teach our kids to be responsible with their money. As I feared, very few schools are teaching students these skills in school yet, so it is up to parents to do it.

I hope that MassMutual continues to hold these chats because I found them helpful and the more participants, the more knowledge sharing that can happen. The more we know, the more we can help our kids learn.

Before the chats, hadn’t actually seen the program, which was developed in partnership with EverFi, until I arrived at the school.

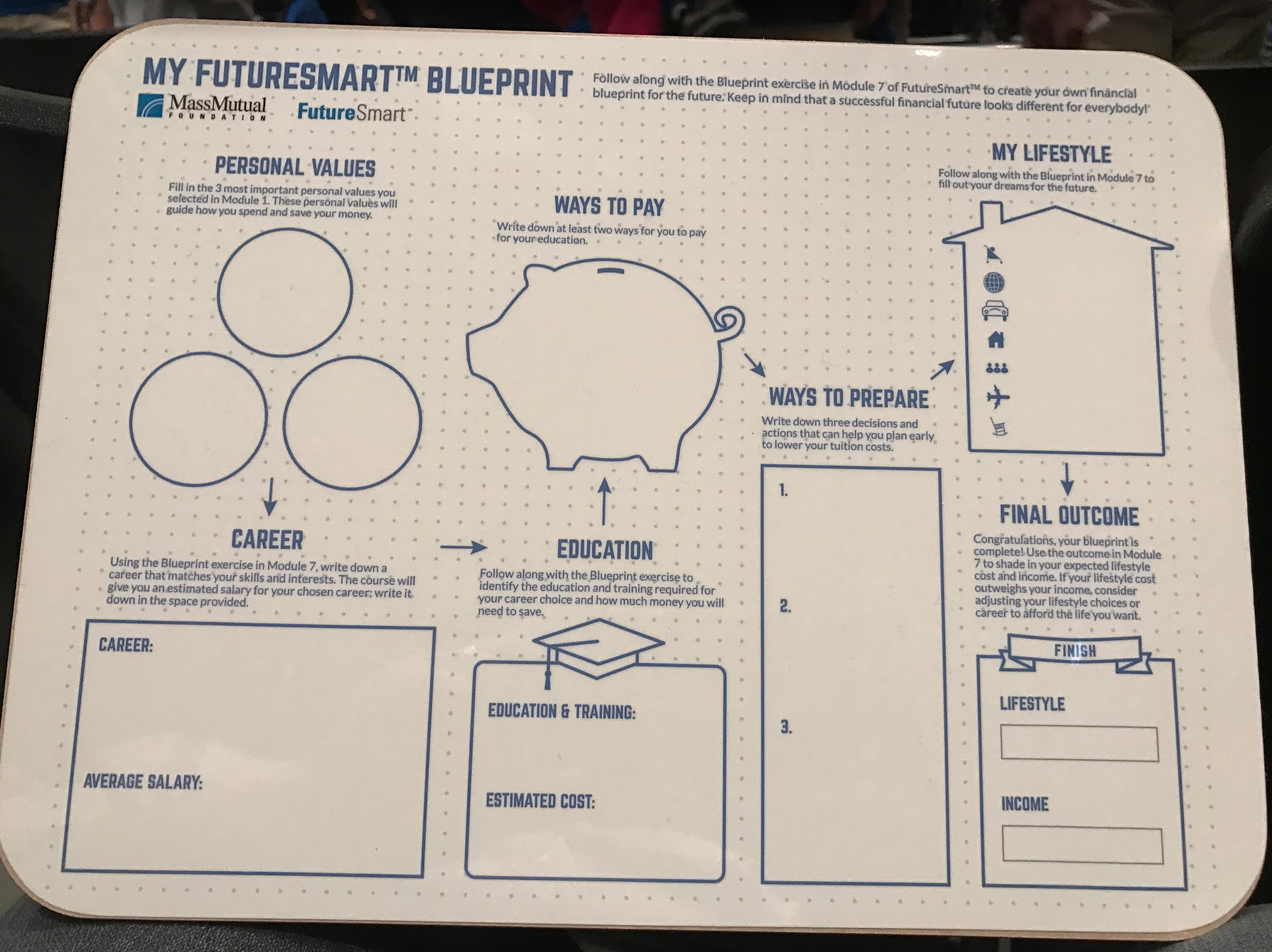

Students are lead through different financial simulations that have been turned into fun learning games. They are taught about planning and budgeting. Encouraged to complete blueprints around what is important to them and how to choose career paths that will help them achieve their goals.

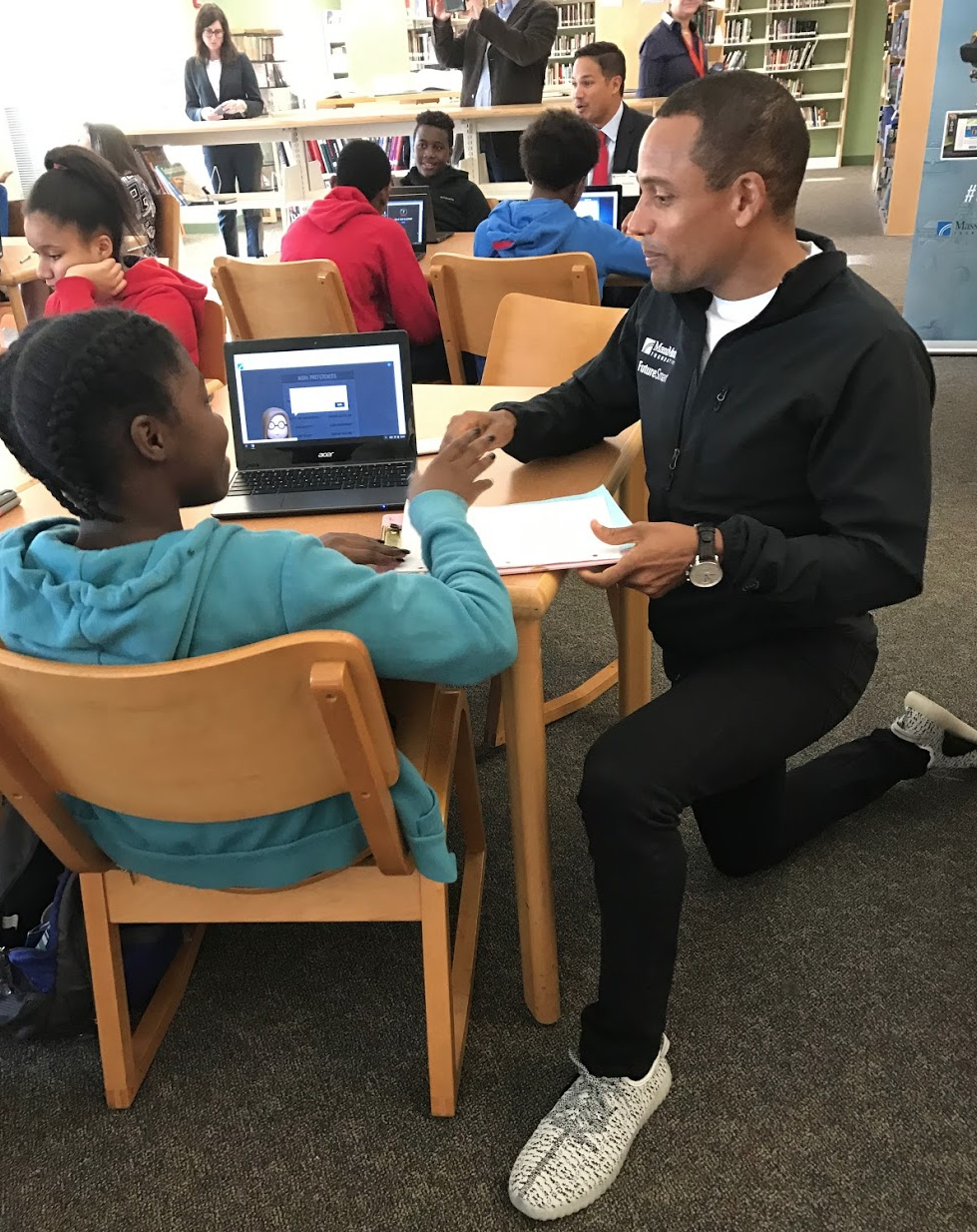

Actor and author Hill Harper was on site for the launch and gave a passionate talk to the kids. I was not familiar with his work, but it was instantly obvious how dedicated he is to this program and helping kids not only learn about money, but also embrace the importance of understanding what it means in their lives.

Two things he said to the students jumped out at me:

“Money is just a tool to help us achieve our dreams.”

“The more education you get, the more options you have.”

The FutureSmart program is free to schools that would like to implement it. You can find out more at http://futuresmart.massmutual.com/

I’m honored to be partnering with the MassMutual Foundation to share information on their programs helping students and families deal with the financial stress that is all around us. I’m learning a lot and hope that by sharing, you get something out of it as well.

Disclosure: This post was sponsored by Massachusetts Mutual Life Insurance Company (MassMutual). All opinions are my own.